By Mary Quist-Newins, president of Moneyweave, LLC

By Mary Quist-Newins, president of Moneyweave, LLC

It’s been said that, “Failing to plan is planning to fail.” This is an eternal truth when it comes to money, and especially so for women business owners. Why? Because for most, their business generates more than half of their household’s income and a significant portion of total net worth. Effectively planning and then allocating business income/capital is critical to the attainment of financial security. Since women are prone to certain financial risks at higher rates than men (e.g., longevity, lower lifetime earnings, disability, caregiving), planning is even more important.

In general, the state of retirement preparedness among business owners is troubling. According to a recent study of 400 business owners by BMO Harris Wealth Management, three in four participants had less than $100,000 saved in retirement funds. Fewer than one in 10 had accumulated more than $500,000, which is considered insufficient for many.

The possibility of early retirement due to unforeseen circumstances compounds the consequences of inadequate preparation. A recent study from the Employee Benefit Research Institute found that almost half of Americans retire sooner than they planned. Of these, 56 percent cited health changes, disability and family caregiving as primary reasons. Just 24 percent stated they were able to afford earlier retirement and 10 percent said they wanted to do something else. Lesson learned? When planning for retirement (as with anything else), it’s important to consider both the upside and downside possibilities.

Retirement Planning Concerns and Actions

Perhaps in recognition of the gaps in preparedness, most business owners, male and female, cite concern over retirement planning. However, there is a common disconnect between being concerned and taking necessary action to address those concerns. I have witnessed this in clients as a vague sense of unease. As an academic, I learned even more.

For part of my career, I had the privilege of holding the nation’s only endowed academic chair devoted to the study of women and money and founding the Center for Women and Financial Services at The American College. One of my favorite projects was co-writing a quantitative research study about the financial goals, concerns and actions of women business owners in 2011. More than 1,200 business owners (835 women and 420 men) participated in the study and it was rich with insights.

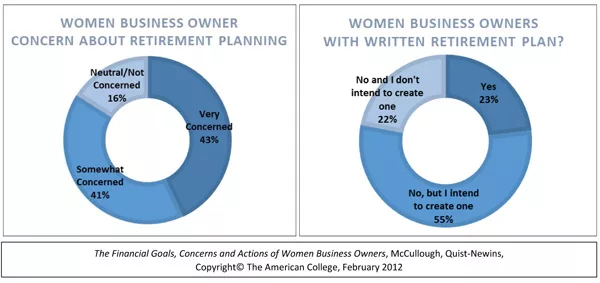

One of the most intriguing results was an apparent disconnect between concern and action as noted in the charts below. (While these findings represent results for women business owners, responses for men in the study were directionally similar).

The findings revealed that while the great majority (84 percent) of women business owners were concerned about retirement planning, fewer than one in four (22 percent) had a written retirement plan. We also learned that less than one in 10 (9 percent) of women and one in 20 men business owners had a written business succession plan. This, despite more than half of all respondents saying they were concerned about maximizing the value of their business to help fund retirement—a significant indicator of the importance of succession planning.

What Keeps Business Owners From Planning for Retirement?

Many business owners view the prevailing notion of retirement—a retreat from working life—as a foreign and sometimes dreaded concept. After all, why “retire” in the conventional sense when you’re pursuing your vision for the business, family and personal life?

Many are also pre-occupied with meeting the needs of the “here and now,” like cash flow and accumulation of reserves. Others plow everything back into the business, sometimes not even taking personal income let alone putting money aside for retirement.

Without good planning, retirement can just be an abstract concept. In the press of the business, it can be hard to separate oneself from the tangible “here and now” to plan for an intangible retirement concept.

While these competing demands are understandable, they are fundamentally dangerous if they get in the way of a well-thought-out and prudent plan. After all, most business owners take on far more risks than those employed by others. This means taking action to plan for retirement is critical and especially important for women due to the higher risks mentioned above.

Five Tips for Action

1. Reframe “Retirement”

I encourage clients and students to think less about “retirement” in the conventional sense and think more about being “financially independent” since many envision themselves working late into life. Financial independence means having the option, not the requirement to work. It is that point in time when you have sufficient assets to provide target income for the rest of your life, your spouse’s life and the legacy you wish to leave others.

2. Visualize and Quantify Income

Next, identify your desired lifestyle, interests and passions to explore. Will you move, downsize, provide funds to children and/or charity or pursue other lifelong goals? How will life fundamentally change from what it is today? Quantify these changes in your monthly expenses. Some use a simple income replacement formula for quantifying income needs using a 70 or 80 percent replacement ratio. (While I have serious concerns about the limitations of this approach as a CERTIFIED FINANCIAL PLANNER®, it’s a starting point at the very least).

3. Do the Math

Thanks to really great calculators that are widely available for free online, running a simple retirement projection is quick and easy. Here is a link to a basic retirement savings calculator to get you started.

While online calculators are limited in their capabilities (for example, they don’t evaluate the impact of higher inflation on expense line items like health care), they can be an important step in the planning process. How? Because they increase awareness of what it might take in capital assets to fund retirement/independence. Even if you discover that funding gaps are deep and wide, increasing clarity gives you greater control and more purposeful action. It’s better to have this information early so you can adjust your thinking, plan and course of action, as necessary.

4. Diversify Your Retirement Resources

We all know the wise old saying about not putting all of our eggs in one basket. So it goes with diversifying resources for financial independence. Diverting income from the business to build up personal retirement/independence savings is essential to managing risk and accumulating resources, sometimes on a tax-favored basis.

Putting in place a basic retirement plan (like Solo 401(k), SIMPLE 401(k), SEP IRA, SIMPLE IRA) is a generally recognized first step. Initially, you want to consider well-diversified funding mechanisms within those plans like low-cost target date mutual funds that give the benefits of strategic asset allocation, rebalancing to a target date (like financial independence when the funds are presumably redeemed) with relatively minimal expense.

5. Consider Hiring a Financial Planner

Resource studies indicate this is an important step for many, especially when creating a comprehensive, written plan. In addition, it has been my experience as a practitioner, academic and student, that retirement planning for business owners can be very complex. Even if you believe you are well on your way, the value of a second opinion cannot be overstated.

All that said, be very careful in your choices here, especially when seeking out a “financial planner” since the use of that term is not currently regulated. I find the “10 Questions to Ask When Choosing a Financial Advisor” by the CERTIFIED FINANCIAL PLANNER® Board really gets at the important qualifications you should be looking for. You can access that tool here.

About the Author

Mary Quist-Newins is a 2017 honoree of Top Women in Finance by Finance and Commerce magazine as well as a 2018 honoree of Women Who Lead by Minnesota Business magazine. She is president of Moneyweave, LLC, a comprehensive financial planning company in Minneapolis, Minnesota. She is also president of the NAWBO Minnesota chapter.