Best Payroll Software for Small Business

The experts weighed in, and we tested the best to bring you our top picks for 2024

Fact Checked

As a business owner, you have a lot on your plate, and payroll software can help you save time and money by supporting payroll and associated tasks. Payroll software automates payroll, ensures paycheck accuracy, and helps you navigate complex tax regulations. With that in mind, we compared all the top vendors and consulted with payroll experts to compile a list of the best payroll software and services specifically for small businesses like yours, so you can choose with confidence.

Our Top Picks

Small Business Payroll Software Reviews

As a small business looking for payroll providers, making the right choice can be daunting. That’s why we evaluated 23 popular payroll providers, ultimately selecting the top five based on our assessment of features, pricing, customer support, and brand reputation. Our guide delves into these industry-leading vendors specifically designed to meet the needs of small businesses. Explore our full methodology to learn more about the rigorous process behind our recommendations.

OnPay

Best for SMBs

OnPay automates the hard things so you can spend more time on what’s important. This makes it especially easy for small to mid-size businesses to pay their teams, save time, and ensure accuracy.

Wrapped up in a single plan, OnPay includes all the highly sought-after payroll features, free account migration, and basic HR services that all SMBs need to run payroll successfully.

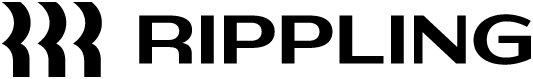

Rippling

Best for Payroll with HR Management

Rippling provides a comprehensive workforce management solution, empowering you to seamlessly oversee every stage of your employees’ journey. It offers flexibility and integrates HR, finance, and IT functionalities tailored to your business needs.

You can access the payroll management tool within the HR module, boasting Rippling’s payroll efficiency and enabling global employee payments in just 90 seconds.

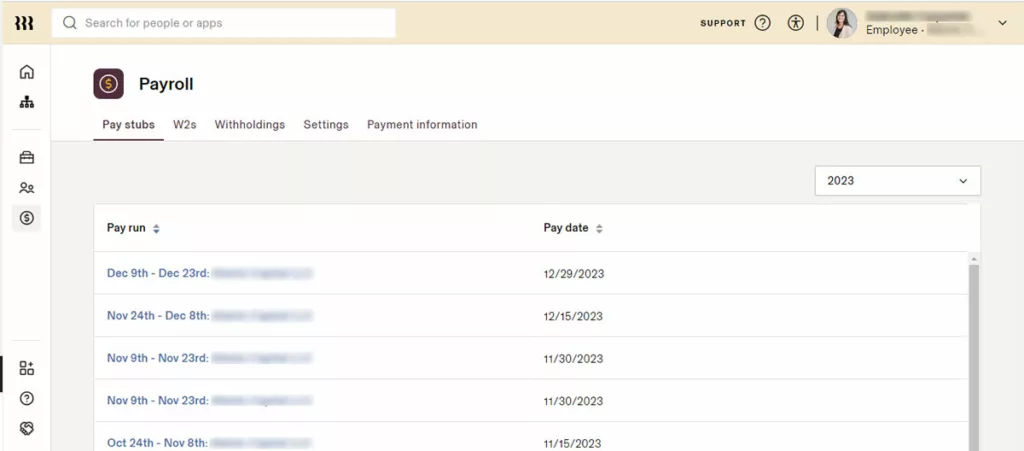

Paycor

Best Payroll Software for Small Business Growth

Offering a range of features, including tax compliance tools, an easy mobile app, and AutoRun payroll processing, Paycor simplifies business operations and optimizes easy payroll processes for your small business.

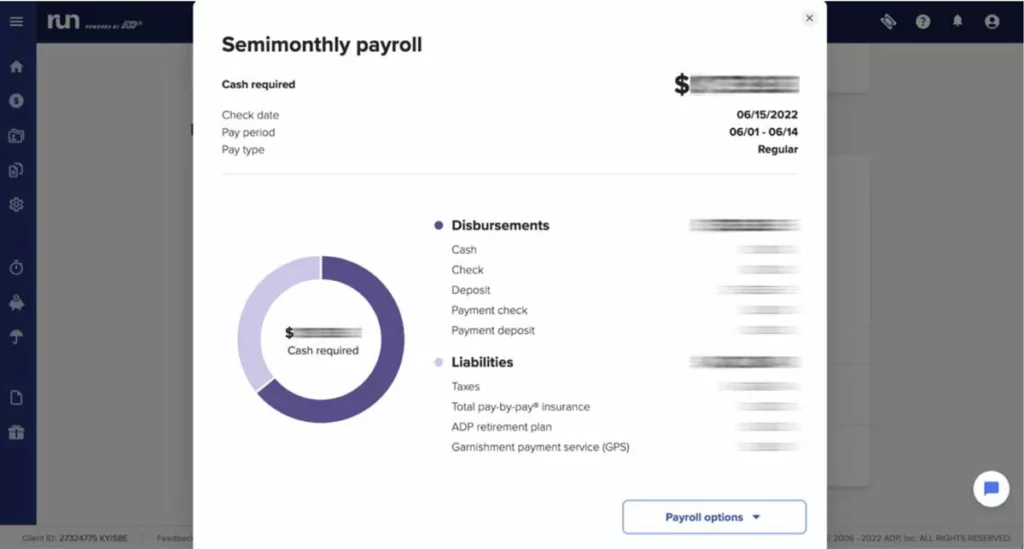

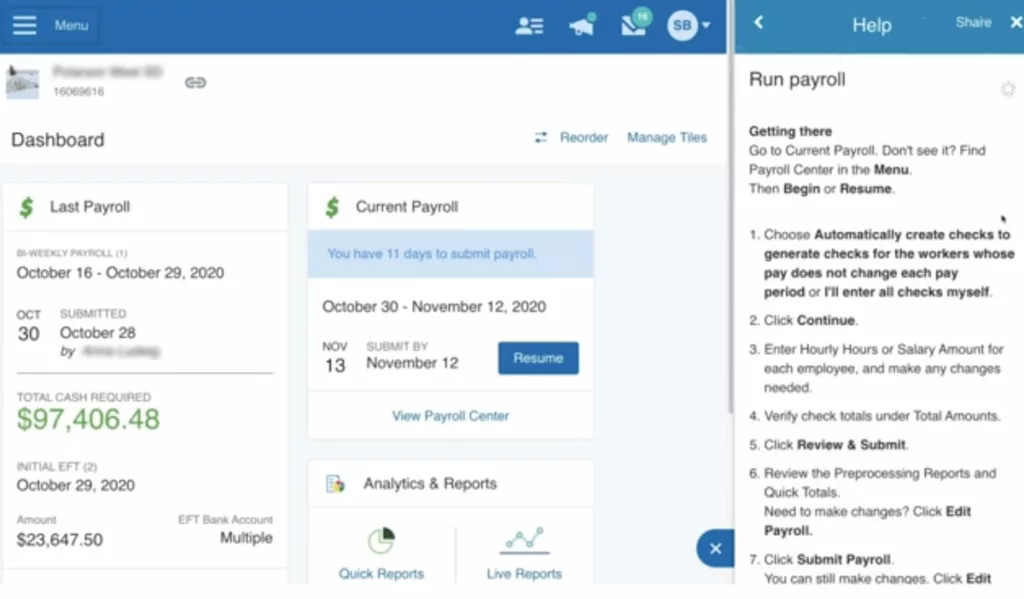

ADP

Best for Automating Recurring Payroll

Equipped to serve large or small businesses, ADP is a powerhouse brand in payroll and HR services. Backed by 80 years of experience and operating in over 140 countries, it’s the go-to for many businesses.

Paychex Flex

Best for Payroll Reporting

An all-in-one payroll software, Paychex offers the payroll technology, compliance experts, reporting, and HR support you need to run your business. Paychex Flex is an online payroll software that makes payroll possible and accurate with just a few clicks.

It provides an easy-to-use user interface for admins and employees, as well as dedicated payroll support.

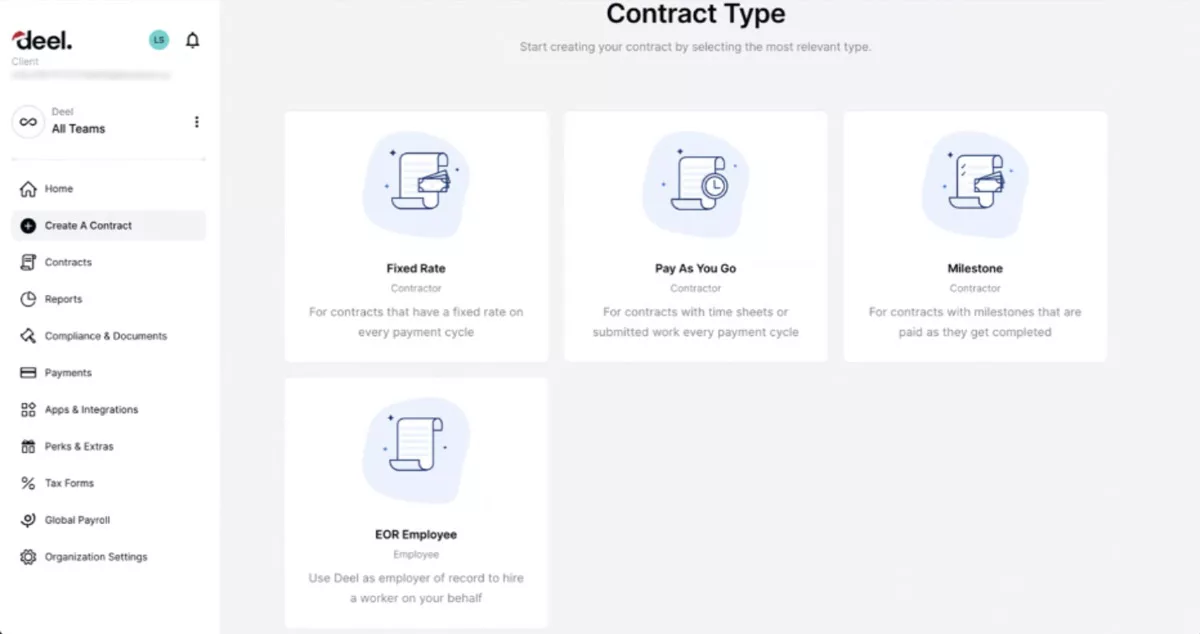

Deel

Best for Global Payroll

Deel offers a streamlined global payroll solution, simplifying payroll across 150 countries and 90 currencies for small businesses. With dedicated local compliance experts and the option to serve as Employer of Record, Deel ensures ease, compliance, and added features for managing your international workforce.

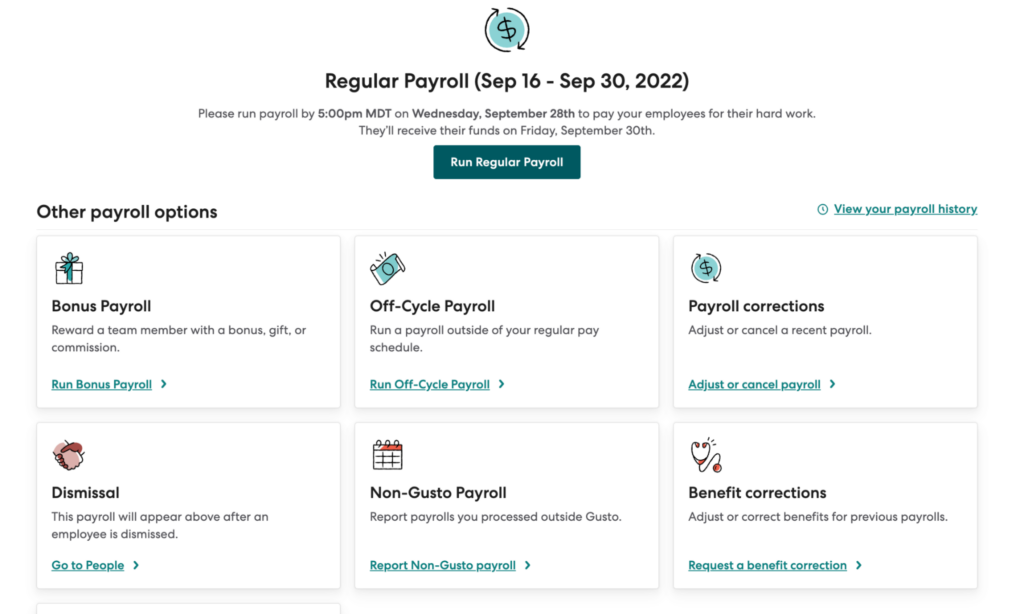

Gusto

Best Payroll Software for Startups

Gusto makes every effort to appeal to small businesses – especially those paying contractors. With a Contractor Only plan, if you’re paying exclusively contractors, you get the base fee waived for six months. The payroll software company offers appealing features like payroll processing, compliance, employee benefits administration, new hire reporting and onboarding, and PTO time tracking – all saving you time and energy.

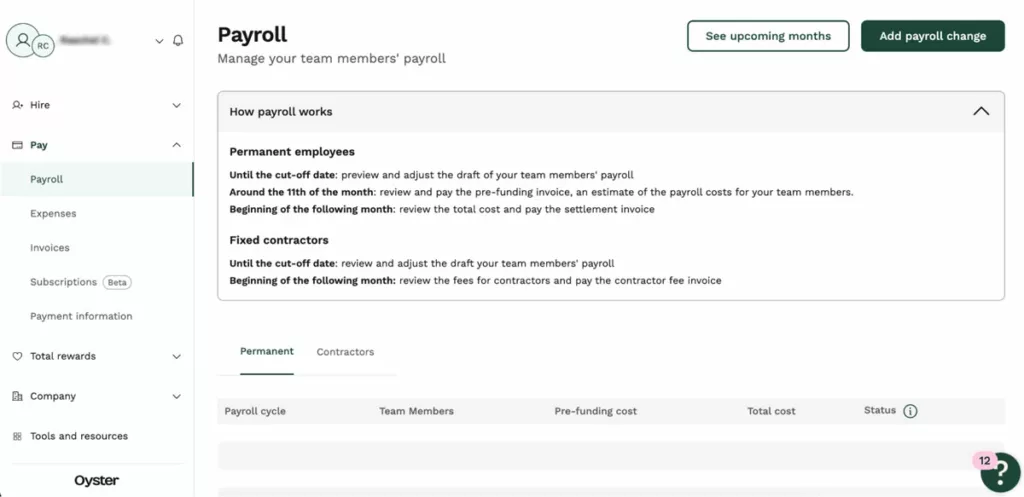

Oyster

Best for Global EOR Services with Payroll

Oyster is an Employer of Record company that enables small businesses to hire global full-time employees and contractors. Payroll is a huge part of that, and Oyster HR enables reliable, efficient, and compliant local payroll no matter where your employees are located.

Justworks

Best for HR and Compliance Support

Justworks has two options: a professional employer organization (PEO) and a payroll plan. Through Justworks payroll, you can pay remote employees, contractors, and one-off projects, making it a versatile tool for confidently paying your employees. Supportive HR tools are also included, taking even more off your plate.

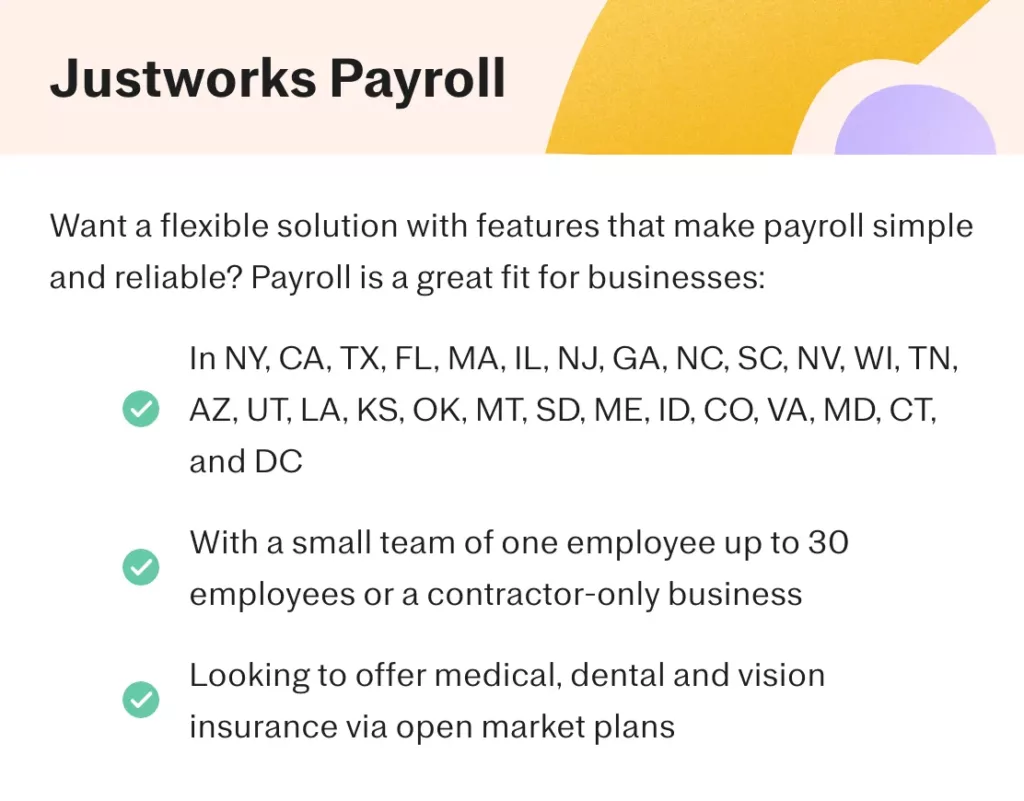

SurePayroll

Best for Simplified Payroll

With no setup fees or contracts, SurePayroll caters to small businesses needing straightforward pricing and the ability to cancel at any time. SurePayroll is a long-term, trusted provider of payroll features like extended customer service hours, free direct deposit, and unlimited payroll runs.

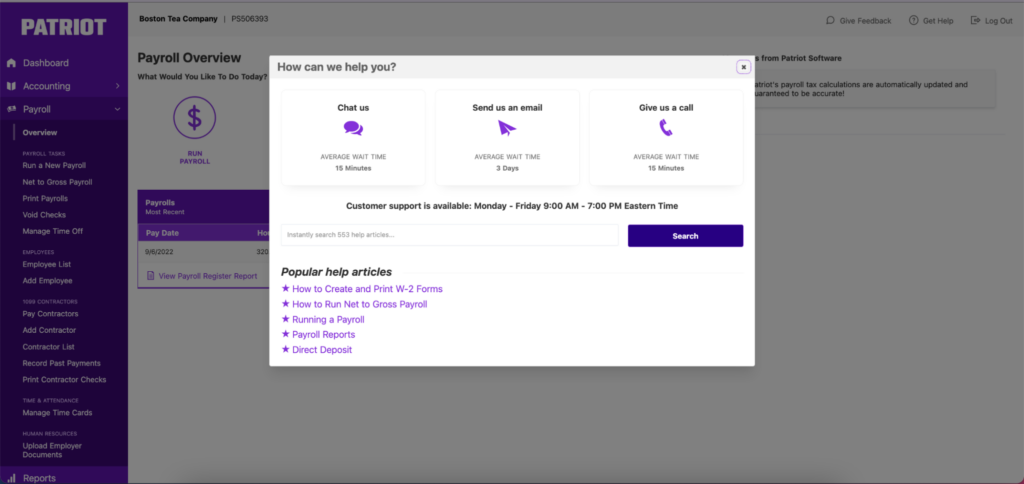

Patriot

Best Payroll Software for Teams on a Budget

Affordability is a big draw for Patriot’s payroll software. It’s one of the most budget-friendly options out there. It’s designed for small businesses with up to 500 employees or accountants handling client payroll.

Compare the best small business payroll software side-by-side

| Brand | Best for | Starting Price | Free Option |

|---|---|---|---|

| Onpay | SMBs | $40 / month + $6 / employee | 30-day free trial |

| Rippling | HR Management | $8 / month / user | None |

| Paycor | Rapid Growth | Request a quote | None |

| ADP | Automating Recurring Payroll | Request a quote | None |

| Paychex Flex | Payroll Reporting | $39 / month + $5 / employee | None |

| Deel | Global Payroll | $49 / month / contractor | Free plan |

| Gusto | Small Teams | $40 / month + $6 / month / employee | Free plan |

| Oyster | Global EOR Services w/ Payroll | $599 / employee / month for EOR Services | 30-day free trial |

| Justworks | HR and Compliance Support | $50 / month + $8 / employee | None |

| SurePayroll | Simplified Payroll | $19.99 / month + $4 / employee | 180-day free trial |

| Patriot | Teams on a Budget | $17 / month + $4 / employee | 30-day free trial |

What is payroll software?

Efficiently handling your payroll is no small feat. It requires precision and unwavering compliance. Fortunately, payroll software makes this critical task smoother, guaranteeing precise and punctual compensation for your employees and contractors, all while keeping your company in pristine tax-filing shape.

Timely and accurate payroll is expected from your employees and plays a pivotal role in retaining top talent. The Internal Revenue Service (IRS) underscores the wisdom in using payroll software, highlighting its use as a smart business decision. It keeps you on track with filing deadlines and ensures your business consistently meets deposit requirements.

What does payroll software do?

- Ensuring timely payments to your employees keeps them happy and fosters trust among your workforce and company leadership.

- Efficiently managing payroll and taxes while maintaining meticulous payroll reports and record-keeping is crucial for the smooth operation of your business.

- Embrace the power of payroll software to save valuable time, guarantee precise compensation, and meet the critical demands of tax compliance.

How does small business payroll software work?

Small business payroll options work in two different ways.

First, there is cloud-based payroll software for small businesses like Gusto and Deel, which allows you to manage your payroll internally by simplifying your payroll processes and tasks.

Then, there are outsourced payroll services for small businesses like Justworks that take the entire payroll burden off your hands. They handle all payroll tasks for you, eliminating the need for an in-house payroll team and ensuring accurate and hassle-free payroll management for you.

What are the benefits of small business payroll software?

Adopting payroll software brings many advantages to businesses, making it a savvy choice for small business owners. In fact, 61% of companies already outsource some or all of their payroll operations, and it’s not surprising why. First, it streamlines essential processes, making payroll management a more efficient and hassle-free task. It provides a digital filing cabinet for all employee data, ensuring meticulous organization and easy accessibility.

When employees are paid accurately and on time, it naturally fosters engagement and commitment among your team. Plus, payroll software automates tasks, resulting in significant time and cost savings for your company.

If you decide to opt for third-party HR services, the benefits continue. Outsourcing critical HR functions, such as payroll management, simplifies compliance by ensuring timely tax filing and deposit obligations are met. This saves you from potential compliance headaches and strengthens employee loyalty, as they appreciate smooth and reliable paycheck handling.

“Honestly, I can’t imagine paying employees without payroll software,”

Krystal Speed, CEO of HR Strategist

Using payroll software is a win-win solution, offering convenience and efficiency for business owners while enhancing the overall well-being of their organizations.

“It saves you time by streamlining and automating specific aspects of the payroll process. Also, much of the payroll software out there supports you with remaining legal and compliant. There are so many laws, regulations and compliance tasks associated with payroll that are too important to leave to manual processes,” Speed says.

Payroll software for small businesses offers cost-effective, time-saving, accurate, and scalable solutions, along with various features that enhance employee and payroll data management.

These advantages help you streamline your payroll processes and maintain compliance with confidence. Other benefits of payroll for small businesses include:

- Cost-Efficiency

- Time Savings

- Accuracy and Compliance

- Scalability

- Employee Self-Service

- Reporting and Analytics

- Integration

- Mobile Accessibility

How much does small business payroll software cost?

When considering the cost of payroll plans for small businesses, it’s important to note that they typically involve a monthly base fee coupled with an automatic price per employee or contractor per month.

The most expensive will be to outsource payroll altogether and in most cases that isn’t what small businesses need. Cost-effective alternatives that don’t outsource payroll include Patriot, starting at a monthly fee of $17 and an additional charge of $4 per employee per month. SurePayroll is priced at $19.99 per month and $4 per employee per month. Gusto’s plans are billed the same way. However, it does present a unique option, waiving the monthly fee for six months if your company solely employs contract workers, with a cost of just $6 per contractor per month.

Paycor’s pricing structure can vary, but feedback from users suggests an approximate monthly cost of around $400 for businesses with 10 to 30 employees. Consult the following chart to see a side-by-side price comparison.

| Provider Name | Monthly Base Price | Cost Per Employee / Month |

| Paycor | Request a quote | Not disclosed |

| Gusto | $0 | $6 (for contractor payments only) |

| SurePayroll | $19.99 | $4 |

| Patriot | $17 | $4 |

| Deel | None | $49 |

How to choose the best payroll software for your small business

Choosing the right payroll software is an important decision for small business owners, as it directly impacts the efficiency and accuracy of your payroll processes.

“When choosing payroll software, I look for a few key features. It needs to be easy to use as an employee, manager, and admin. I look for flexibility in payroll runs (when, how often, and off-cycle runs). It is essential that the software has automation and workflows built in to help make our tax filings, reporting, and other compliance tasks simple,” says Krystal Speed, CEO of HR Strategist.

To make an informed choice, you should start by assessing your specific needs and objectives. This includes considering:

- The size of your business

- The complexity of your payroll requirement

- Future growth plans

Next, you should evaluate the software’s payroll tools and functionalities, ensuring that it offers essential payroll functions such as:

- Tax calculations

- Same-day direct deposit capabilities

- Reporting features

Additionally, you should carefully review pricing structures, read user reviews, and take advantage of free trials to get valuable insights into the software’s performance and reliability. To find the best payroll provider for your business, we recommend contacting two or three companies on our list to get customized pricing and plans based on your budget and needs.

“Please do all the research about the software prior to implementing and ensure that all the data is accurate,” cautions a Senior Payroll Administrator we recently surveyed. By carefully considering these factors, you can make an informed decision and select the best payroll software that suits your small business’s requirements, budget, and growth plans.

Once you pick a software, “Make sure you take all the proper training and that there is a support team ready to help you when you hit any roadblocks,” recommends a Director of Human Resources who completed our recent survey.

Small Business Payroll Frequently Asked Questions (FAQ)

What is small business payroll software?

Whether you have a single employee or a workforce of 50, a dependable payroll system is essential to ensure consistent, accurate, and on-time garnishments. These payroll solutions are a vital tool for managing employee compensation. Payroll software providers for small businesses encompass various tasks, including calculating net pay, withholding payroll taxes, ensuring timely payments, and maintaining precise records of all payouts and pay stubs.

What is the best payroll software for small businesses?

“I’ve found the best payroll software to be one that is part of my HRIS suite or integrates seamlessly with other HR software and that has taken into account what’s needed to manage payroll accurately, efficiently, and reliably,” says Krystal Speed, CEO of HR Strategist. Many payroll software vendors on our list offer add-on HR software that works seamlessly with the payroll software. This is especially useful for small businesses as budget restraints often prevent you from paying for an entire HR system. A more manageable option is a platform that allows you to piece together exactly what you need and will use.

What is the easiest way to do payroll for a small business?

The simplest way to handle payroll for a small business is by using dedicated payroll software or outsourcing the task to a payroll service provider. “Honestly, I can’t imagine paying employees without payroll software,” says Speed. “There are so many laws, regulations, and compliance tasks associated with payroll that are too important to leave to manual processes.”

Choosing one of these options streamlines the process, calculates taxes for e-filing, generates paychecks, and ensures compliance with employment regulations, saving you time and reducing the risk of errors.

What is the cheapest payroll software to use?

The affordability of payroll software can vary depending on your business needs and the number of employees you have, as well as if you choose an in-house payroll software solution or an outsourced payroll service – the latter is more expensive. Our list is made of all payroll software vendors that are affordable. The cheapest we reviewed is Gusto’s Contractor Only plan, followed by Patriot’s Basic plan, where you manage your taxes and tax filings.

Methodology: How we choose the best payroll software for small business

To provide you with the most reliable recommendations for payroll software tailored to small businesses, we scoured the market and compiled a comprehensive list of 23 payroll service providers, focusing our attention on ten vendors with significant online visibility. From this pool, we meticulously selected five standout vendors, drawing upon their standout features, esteemed brand reputation, commitment to pricing transparency, and quality of customer service.

Our approach to gathering information involved a rigorous validation process. We sifted through data from vendors and corroborated it with insights from customer and expert reviews and thorough examinations of vendor and parent company websites.

Through an objective scoring system, we assessed and ranked each vendor on four critical criteria, each contributing 25% to the final score. These key factors included:

- Customer Service: we assessed the availability of customer support channels, looking for a diverse array of support options, including resource libraries, live chats, email assistance, and dedicated customer service lines.

- Features: including direct deposit, employee portal or mobile app, tax management capabilities, automated time tracking, and the optional inclusion of HR features or add-ons.

- Pricing: we drew comparisons of the actual costs associated with each payroll service while gauging the accessibility of pricing information.

- Reputation: we read countless reviews expressed by customers and professionals about each company, analyzing them to determine the reputation of each vendor.

Our method includes thorough research and stringent evaluation practices so that we can provide the most well-informed guidance for payroll software that best aligns with your unique small business needs.

Related Articles