Small Business Payroll Statistics for 2024

Fact Checked

In the United States, there are around 33.2 million small businesses. However, 81.7% of those small businesses are nonemployer firms, meaning they have no employees. The remaining 18.3% are employer firms and do have paid employees. According to the SBA’s Office of Advocacy, these small businesses employ 46.4% of private sector employees.

With nearly half of the private sector working for small businesses, it is no surprise that payroll is vital to small business operations. It needs to be handled correctly and efficiently to avoid costly mistakes.

We gathered the most recent small business payroll statistics for 2024 to help business owners and HR professionals make informed decisions about running payroll.

Key Takeaways:

- 50% of employees will look for a new job after just two payroll errors.

- 73% of employees say higher wages are more important to them.

- 49.14% of workers said a late paycheck makes it “very difficult” to meet financial obligations.

- Companies have an average payroll error rate of 1.2% each pay period.

- About 2.5% of workers (4 million) switch jobs each month.

Small Business Payroll Statistics

Only 18.3% of small businesses are employer firms. However, those small businesses account for 99.7% of firms with paid employees. Since these small businesses employ millions of American workers, delivering pay on time and correctly is essential.

- In fact, 50% of employees will look for a new job after just two payroll errors.

Ensuring payroll is error-free is a good way to help employee retention.

In addition, employee wages affect retention. A survey conducted by PayrollOrg (the combination of the American Payroll Association and the Global Payroll Management Institute) asked respondents what was more important to them:

- 73% of employees say higher wages are more important to them.

- 27% say better health benefits are more important.

It’s not surprising that workers value higher wages over health benefits. A study from the Pew Research Center found that low pay was one of the top reasons Americans quit their job.

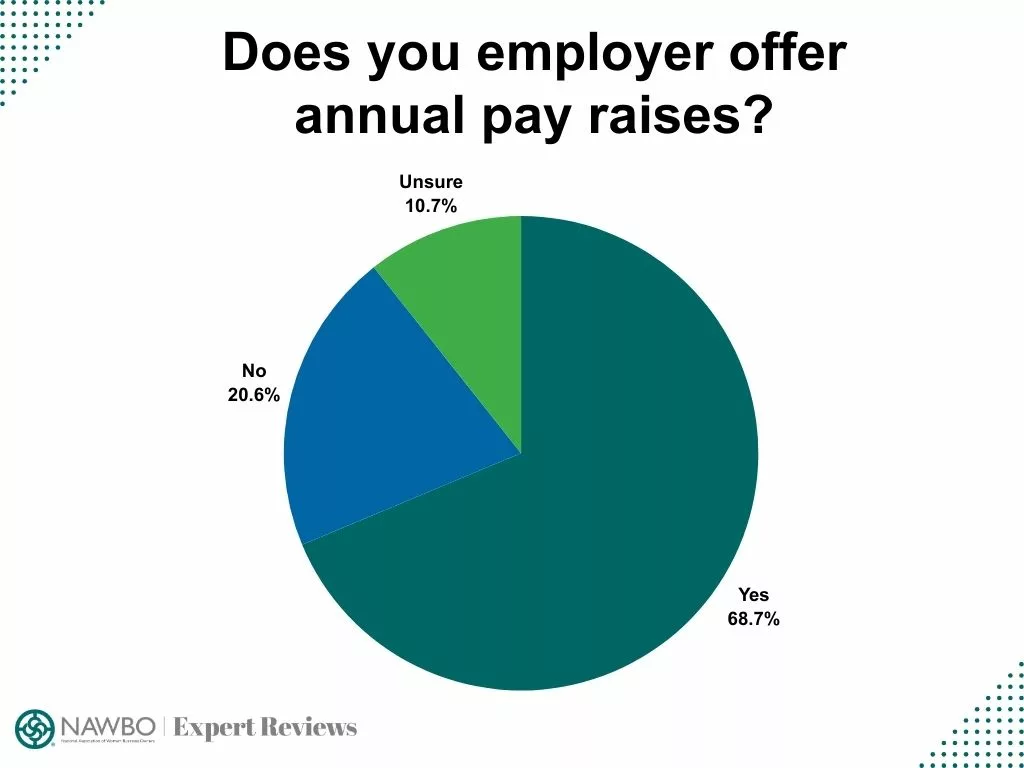

Many employers recognize the importance of higher wages, but not all employers offer annual raises, at least according to employees.

- 68.70% of workers say their employer offers annual pay raises.

- 20.64% said their employers do not provide annual pay raises.

- 10.66% were unsure.

Employers who do offer annual raises are budgeting for a 4% salary increase in 2024. Unfortunately, many workers feel these raises are insufficient to keep up with inflation, especially after the pandemic.

- 78.72% of employees say pay raises are not enough to keep up with the rising inflation rate.

With inflation continuing to rise and wages lagging, PayrollOrg asked respondents how a late paycheck would affect them.

- 49.14% said a late paycheck would make it “very difficult” to meet their current financial obligation.

- 29.15% said it would make it “somewhat difficult” to meet their obligations.

- Only 9.50% said it would be “not at all difficult.”

The majority of workers say they would struggle to meet their financial obligations if a paycheck is late, even by one week. Luckily, most workers do receive their paychecks on time:

- 91.01% of workers say their paycheck is always delivered on time.

- 7.60% say it’s on time but occasionally late.

- 0.79% say their paycheck is often late.

- 0.60% are unsure whether they received their check on time.

When asked about the correctness of their payroll withholdings and net amounts:

- 52.65% of employees are “very certain” that their paychecks are correct each time.

- 32.78% are only “somewhat certain” that their paychecks are always accurate.

Employees can receive pay in multiple ways; however, the most common is direct deposit.

- 95.15% receive their pay via direct deposit.

This method allows employees to receive their paychecks faster by putting the money directly into their accounts without going to a bank. Usually, money is deposited into their accounts at the end of the designated pay period.

However, some people receive their wages immediately as they earn them. This method is often called “earned wage access” or “on-demand pay,” and it is not as popular among workers.

- Only 26.39% of workers say they’d like on-demand pay rather than standard pay periods.

- 47.95% say they would not want to receive pay this way.

The PayrollOrg survey also asked respondents whether their employers offered a self-service portal that allowed employees to view their pay and benefits online.

- 87.31% of employees said their employers offer a self-service portal.

- 8.65% said their employers did not provide one.

- 4.04% were unsure.

Allowing employees to view their pay and benefits is an excellent way to streamline HR and reduce errors. Avoiding payroll errors is important because it will not only improve employee retention but also save money.

- Companies have an average payroll error rate of 1.2% each pay period, according to the U.S. Bureau of Labor and Statistics.

This error rate adds up quickly. For instance, if you have 100 employees making $900 a week, those “small” errors will cost you $56,647 at the end of the year.

Additionally, small businesses need to pay the correct amount of payroll taxes. These taxes include Social Security and Medicare. If you pay the incorrect amount, or not at all, you can face penalties and graduated accruing fees of up to 15% until the issue is resolved.

- According to the IRS, 40% of small and medium-sized businesses are fined for failing to deposit withholdings, miscalculating taxes, or submitting incorrect filings.

Small businesses can also get in trouble if they misclassify their employees as independent contractors. When workers are misclassified, they miss out on benefits and protections, and the state and federal governments lose billions in revenues annually—something they do not look favorably upon. Businesses that misclassify their workers can be held liable for the employment taxes.

- 10% to 30% of employers misclassify employees as independent contractors.

Using online payroll systems can help ensure that your employees are correctly classified and that all taxes are properly withheld.

- 61% of companies outsource some or all of their payroll operations.

A study by Deloitte looked at how businesses in America and around the world use payroll. They found that:

- 91% of respondents use only one type of payroll system.

- 9% utilize two or more systems.

- 80% of respondents have only one insourced payroll technology

- 20% use two or more insourced payroll technologies.

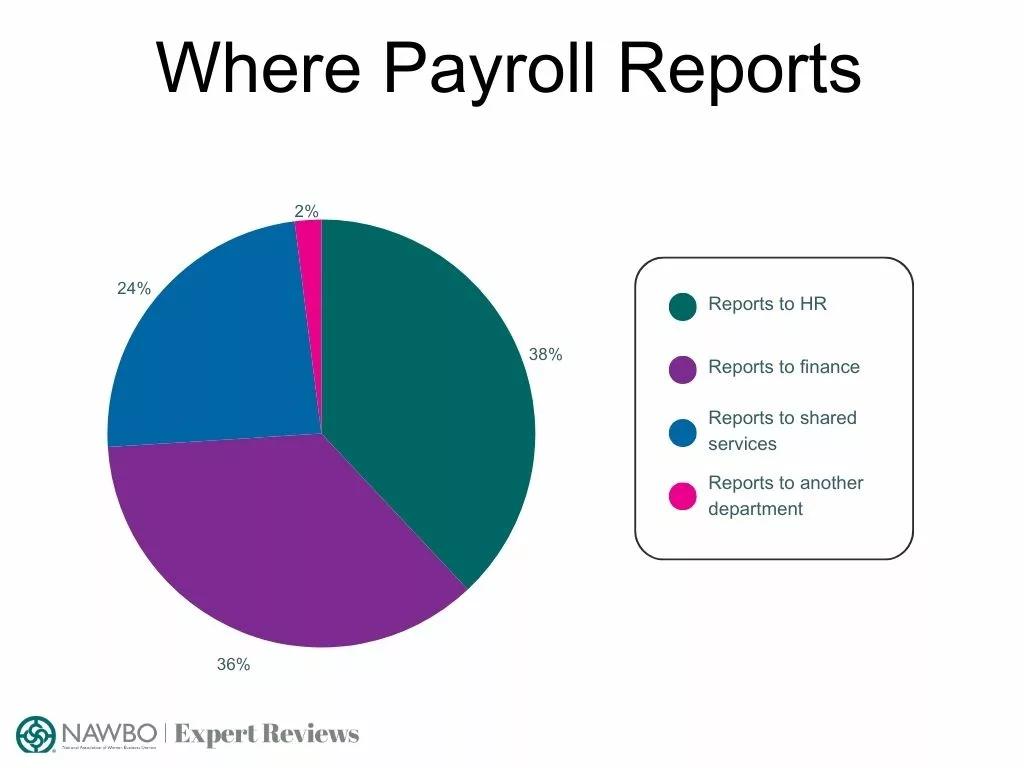

Interestingly, not all small businesses have their payroll report to the same department.

- 38% of respondents say payroll function reports to HR directly

- 36% say it reports to finance

- 24% say it reports to shared services

- 2% say payroll reports to another department

No matter what department handles payroll reports, as long as they ensure payroll is accurate and on time, businesses can avoid fines and improve retention.

Pay Frequency

Generally, payroll is run weekly, biweekly, semimonthly, or monthly. Some states have laws about which pay frequency businesses need to use and other unique laws that you need to be aware of.

According to the U.S. Bureau of Labor Statistics, biweekly payroll is the most common pay period.

- 43% of companies run payroll biweekly. That’s 26 pay periods per year.

However, sometimes businesses need to pay their employees off-cycle. One of the most common reasons for these types of payments is when an employee quits or is fired.

- 30% of employers said that terminations are the most common reason for off-cycle payments.

This is because most states require off-cycle payments in the case of termination. Employers are expected to provide final wages within a certain timeframe. In most cases, the issue of final payment depends on whether the employee was fired or quit.

As a business leader, it’s important to know what your state’s laws are about the topic. You can check with your state’s Department of Labor to ensure you know all the tax laws.

Useful Equations

The Payroll to Revenue Ratio and the HR to Employee Ratio are two useful ways to measure areas of your business to ensure they’re balanced smoothly.

First, businesses can use the Payroll to Revenue Ratio to see what proportion of their revenue is allocated to employee wages and benefits. This will then allow you to assess your labor costs and their impact on the overall profitability.

It can also help you learn about:

- Labor cost efficiency

- Labor intensity

- Profitability impact

- Cost management

- Industry comparison

Payroll to Revenue Ratio = (Total Payroll Expenses / Total Revenue) x 100

Before you use the ratio, you will need to gather some payroll information to ensure all of the data is accounted for:

- Payroll Records

- Revenue Records

- Payroll Tax Reports

- Employee Contracts and Agreements

- Benefits and Deduction Records

- Timekeeping and Attendance Records

- General Ledger and Financial Statements

To see how the equation works, let’s say that a company’s total annual payroll expenses equal $1,000,000. The total revenue for that same period is $5,000,000. After we plug those values into the equation, we can see how much of the company’s revenue is spent on payroll expenses.

($1,000,000 / $5,000,000) x 100 = 20%

In this example, 20% of this theoretical company’s revenue goes towards payroll expenses.

The other equation is the HR to Employee ratio. This equation is similar but shows the average number of HR staff members to employees.

- According to Indeed, the standard rule is 1.4 HR staff for every 100 employees.

But this can change depending on the HR department’s goal. For example, large employers focused on asset prevention benefit from a ratio of 1.00. However, a ratio of 0.60 is normal for departments focused on asset creation.

HR to employee ratio = (Number of HR employees / Total number of employees) x 100

For example, if a company has 500 employees and 7 HR staff, you’d plug those values into the equation.

(7 / 500) x 100 = 1.4

This ratio shows the number of HR staff members per 100 employees a company has. The perfect ratio for your company will depend on your organization’s goals, industry, budget, company size, and the technology available.

Payroll Changes in 2024

In 2024, the IRS plans to continue its efforts to modernize its core technology and infrastructure to improve data security and offer better service. Among those changes, the IRS will provide an e-filing option for amended employment tax returns and e-filing for 20 more forms.

They also plan to enable taxpayers to submit mobile-friendly forms, including:

- Form 941-X

- Form 943-X

- Form 945-X

Another thing businesses need to be aware of is the Work Opportunity Tax Credit (WOTC). This federal tax credit is available to employers who hire workers in groups that face significant barriers to employment.

The WOTC is available for wages paid to qualified individuals who begin work on or before December 31, 2025. Employers must file Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, with their state workforce agency—not the IRS—within 28 days after the eligible individual starts work.

When you file the WOTC, you might be qualified to receive credit for up to a certain amount for the wages paid to the eligible worker.

- The WOTC is equal to 40% of up to $6,000 of wages paid to the individual.

- The individual must be in their first year of employment.

- They need to be a certified member of the targeted group.

- They must perform at least 400 hours of service for an employer.

- The rate lowers to 25% for those who work less than 400 hours but at least 120 hours.

- Certain qualified veterans can have up to $24,000 in wages considered for credit.

Businesses claim the WOTC on their federal income tax returns. It’s important to note that this credit is only available once for each new hire, and employers cannot claim it for rehiring employees.

Another change that could affect payroll is the minimum wage. Currently, the federal minimum wage is $7.25 per hour. However, various states have their own minimum wage requirements, and some cities have different minimum wage rates, so you need to be aware of these and which ones are changing in 2024.

The Labor Law Center announced the new minimum wages per state. Not all states have decided on their new minimum wage rate, so you need to watch for any changes.

These are the states that use the federal minimum wage:

- Alabama

- Georgia

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Wisconsin

- Wyoming

These states changed their minimum wage for 2024:

- Alaska – $11.73

- Arizona – $14.35

- California – $16.00

- Colorado – $14.42

- Connecticut – $15.69

- Delaware – $13.25

- Hawaii – $14.00

- Illinois – $14.00

- Maine – $14.15

- Maryland – $15.00

- Michigan – $10.33

- Minnesota – $10.85

- Missouri – $12.30

- Montana – $10.30

- Nebraska – $12.00

- New Jersey – $15.13

- New York – $16.00

- Ohio – $10.45

- Puerto Rico – $10.50

- Rhode Island – $14.00

- South Dakota – $11.20

- Vermont – $13.67

- Washington – $16.28

States that are not listed have not changed their minimum wage rate for 2024 or have not yet decided on their new wage rate.

Employment Facts and Trends

Payroll plays a large role in HR, and what affects HR will also affect payroll, at least in some regard.

It is no secret that most people switch jobs for pay increases. Pew Research found that 60% of workers who changed jobs from April 2021 to March 2022 saw an increase in their real earnings over the next year. However, only 47% of those who remained with the same employer had increased earnings.

- About 2.5% of workers (4 million) switch jobs each month.

- This equals an annual turnover rate of 30% of workers (50 million).

When asked, managers said that employee turnover was one of the reasons they needed to add to their teams.

- 44% of managers cite employee turnover as a reason they needed to add to their teams

- 67% said that company growth is their main reason.

Usually, when workers leave, businesses need to replace them, which can be an expensive task.

- It costs around $4,700 to hire a new employee.

If companies want to improve retention and avoid expensive new hire costs, they can consider increasing wages or offering other incentives to their employees.

- 36% of firms are now offering retention bonuses.

However, if your company is looking to hire new employees, you’ll want to be aware of what job seekers are looking for.

- 42% of job seekers expect to see a salary range in the job posting.

- 57% would withdraw their interest in a position if the employer does not provide it upon request.

Managers who have included the salary range in job postings have positive feelings about it.

- 83% of managers do include salary ranges in job postings.

- 63% of managers say it helps attract the best job candidates.

- 60% say it gives their company a competitive edge.

There are other ways businesses are attracting top talent.

- 51% are increasing starting pay to attract talent.

- 40% of firms are offering signing bonuses.

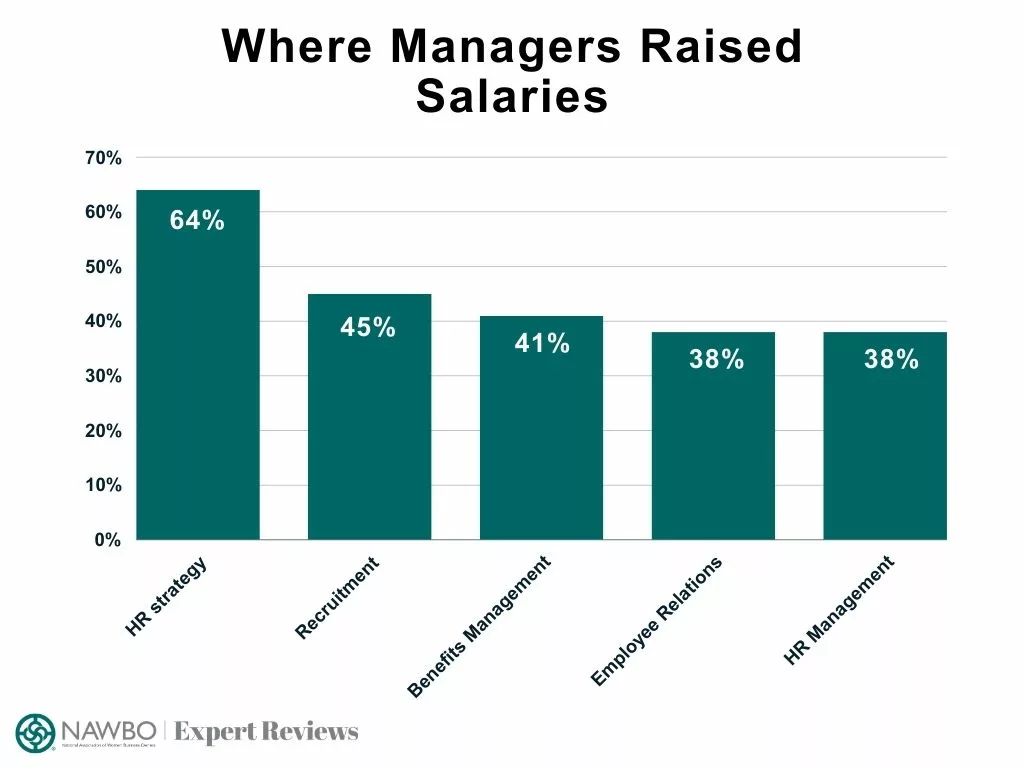

Managers are also raising salaries for different departments to improve retention as well.

- 64% of skill managers say they increased salaries for HR strategy.

- 45% did so for recruitment.

- 41% did so for compensation and benefits management.

- 38% increased wages for employee relations.

- 38% increased salaries of human resource management.

Unfortunately, 46% of employers find meeting job candidates’ salary expectations challenging.

Labor Force Participation and Market Growth

Finding qualified candidates might become even more challenging in the coming years. The U.S. Bureau of Labor Statistics (BLS) predicts that the U.S. economy will add almost 4.7 million jobs from 2022 to 2032. However, the labor force participation rate is projected to fall during this time.

- The labor force participation rate is expected to drop from 62.2% in 2022 to 60.4% in 2032.

- Total employment is also expected to increase 0.3% annually, slower than the 1.2% rate tracked over the 2012−22 decade.

Quit rates across regions have remained relatively steady over the past few months, according to the most recent data from the BLS.

- The Northeast has a recent quit rate of 1.7

- The South has one of 2.8

- The Midwest has one of 2.3

- The West has a recent quit rate of 2.1

The quits rate is determined by the number of quits during the entire month as a percent of employment.

Despite the overall decline in labor force participation, women between the ages of 25 and 54 are expected to increase their participation over the projected period. Men between those ages are expected to participate less.

- Prime-aged working women are expected to increase participation from 76.4% in 2022 to 76.7% in 2032.

- The rate of prime-aged men working is expected to decline 0.2% annually, from 88.6% to 86.7%.

The projected decade is also expected to see an increase in jobs in the healthcare and social assistance sector. So small businesses in that sector should be prepared for possible expansion.

- The healthcare and social assistance sector is projected to create 45% of new jobs from 2022 to 2032.

This growth is already happening. In November 2023, the healthcare sector added 77,000 jobs. This was above the average monthly gain of 54,000.

- Ambulatory healthcare service jobs increased by 36,000.

- Hospital jobs increased by 24,000.

- Nursing and residential care facility jobs increased by 17,000.

Another sector that is expected to grow globally is the HR payroll software market. Payroll service providers will continue to grow and will likely utilize recent technological advancements, incorporating more automation and streamlining systems.

- The compound annual growth rate (CAGR) is expected to be 9.2%, reaching a value of $41.9 billion by 2030.

- The cloud-based payroll software market is also predicted to reach $15.73 billion by 2033, with a CAGR of 10%.

Another reason for this expected growth is the rise of “gig work” with companies like Grubhub, DoorDash, Uber, and Instacart. On-demand pay is becoming more desired with these jobs and is expected to grow from 2023 to 2033.

- The on-demand pay platform market has a projected CAGR of 14.9% during the projected years.

While overall participation in the labor market is expected to decline, specific sectors are expected to increase, and the payroll market should grow steadily.

Employees Per Industry

Small businesses employ nearly half of the U.S. workforce. Employment is concentrated mainly in companies with fewer than 100 employees.

The North American Industry Classification System (NAICS) Association lists detailed business counts by size, counting businesses by number of employees. Below, we list the data for small businesses (those with fewer than 500 employees).

| Total Employees | Number of Businesses |

|---|---|

| 1 – 4 employees | 12,956,533 |

| 5 – 9 employees | 1,940,834 |

| 10 – 19 employees | 825,174 |

| 20 – 49 employees | 417,247 |

| 50 – 99 employees | 153,318 |

| 100 – 249 employees | 89,578 |

| 250 – 499 employees | 33,537 |

Additionally, the BLS recently posted a chart detailing the number of business establishments by size and industry.

| Number of employees per business establishment | < 5 | 5 to 9 | 10 to 19 | 20 to 49 | 50 to 99 | 100 to 249 | 250 to 499 |

|---|---|---|---|---|---|---|---|

| Natural resources and mining | 89,962 | 23,491 | 14,772 | 10,252 | 3,436 | 1,800 | 517 |

| Construction | 623,777 | 135,296 | 81,685 | 52,983 | 16,383 | 7,640 | 1,608 |

| Manufacturing | 183,236 | 57,714 | 50,186 | 48,305 | 23,225 | 17,482 | 5,679 |

| Trade, transportation, and utilities | 1,152,577 | 366,403 | 265,593 | 158,124 | 56,964 | 36,629 | 9,254 |

| Information | 214,181 | 26,747 | 17,307 | 12,967 | 5,141 | 2,949 | 824 |

| Financial activities | 765,284 | 156,239 | 73,233 | 37,959 | 12,085 | 6,573 | 2,021 |

| Professional and business services | 1,816,105 | 251,882 | 156,124 | 108,742 | 39,918 | 24,430 | 7,065 |

| Education and health services | 1,532,556 | 210,691 | 157,917 | 109,929 | 41,418 | 23,538 | 5,542 |

| Leisure and hospitality | 362,674 | 154,477 | 190,359 | 183,475 | 45,229 | 12,157 | 1,832 |

| Other services | 646,756 | 126,952 | 66,136 | 28,538 | 6,212 | 2,840 | 430 |

Most small companies across industries have fewer than five employees, but anywhere from 5 to 49 is also common.

This chart shows that small businesses don’t need hundreds of employees to operate successfully. In fact, the best number of employees will likely differ from business to business. However many employees you end up working with, you’ll need to ensure you have enough revenue to run payroll and cover payroll taxes.

The Bottom Line

Payroll plays a role in any employer firm. It is important to understand how it affects both businesses and employees. If it is run incorrectly, not only will the employer be held liable for any tax issues, but they risk losing employees. Around 50% of employees admit they will look for a new job after just two payroll errors.

Luckily, with the payroll market expected to grow 9.2% annually over the next decade, small businesses will have no shortage of services to help with payroll processing, employee benefits, and tax compliance.

Small business owners have many tasks they need to manage. Not only do they need to run a business, but they also need to ensure employees are satisfied with their pay and the company culture. To help manage all these tasks, 61% of companies outsource some or all of their payroll needs.

Understanding the current trends and payroll data can help owners make informed decisions about labor costs and management. Whether you’re interested in a payroll solution or simply looking for more information, knowing the data will enable you to make the best decisions for your organization or startup.

About NAWBO Expert Reviews

NAWBO Expert Reviews is a software review and recommendation service that empowers small and medium-sized business decision-makers with free tools and expert reviews.

Fair Use Statement

If you found this article helpful, feel free to share it for noncommercial purposes only. When doing so, please link back to this page so that readers can see our full research and findings.

How to Cite this Article

NAWBO Expert Reviews. “What Percentage of Businesses are Small Businesses?” NAWBO.org. Feb. 9th, 2024, https://nawbo.org/expert-reviews/small-business-payroll-statistics/.